CarveOut AwesomeFinTech Blog

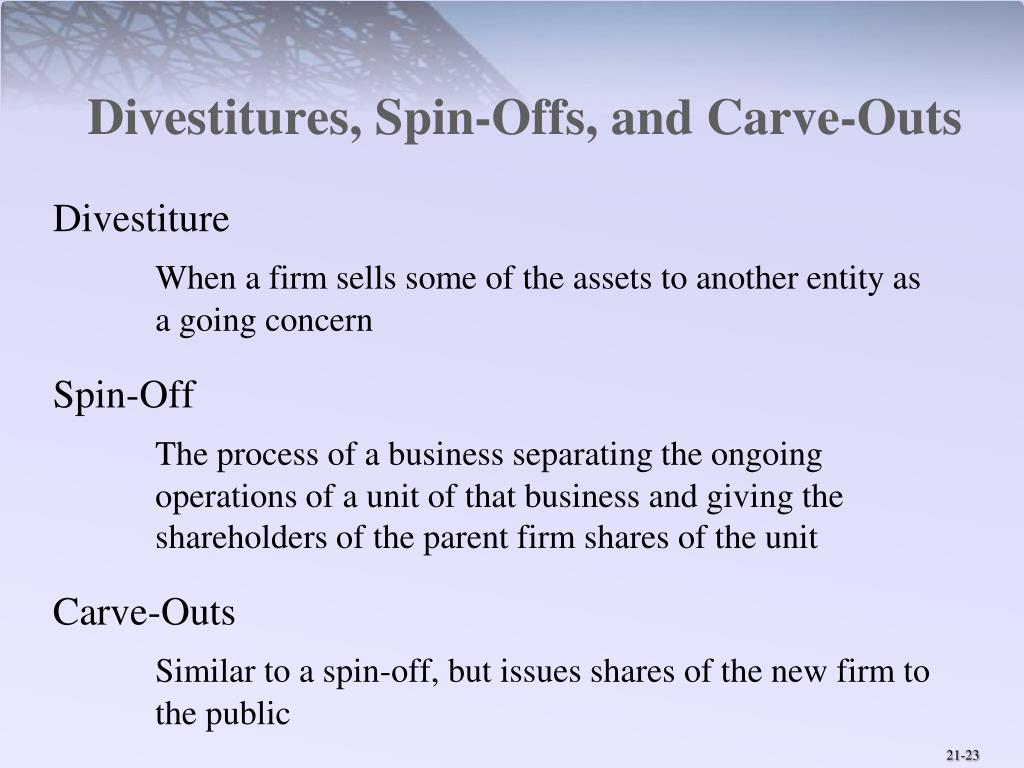

PPT Lecture 11 Mergers, Acquisitions and Corporate Control PowerPoint Presentation ID5490182

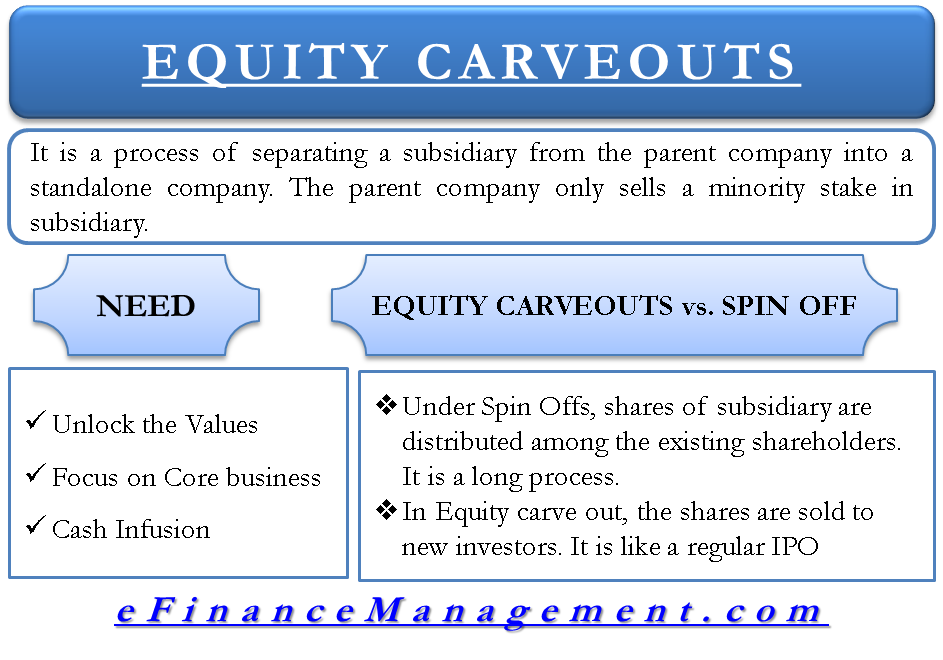

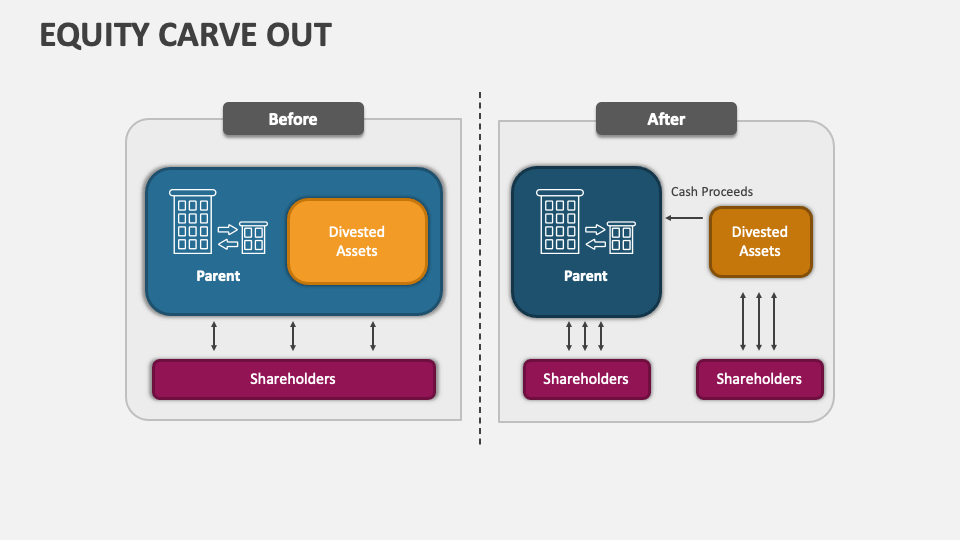

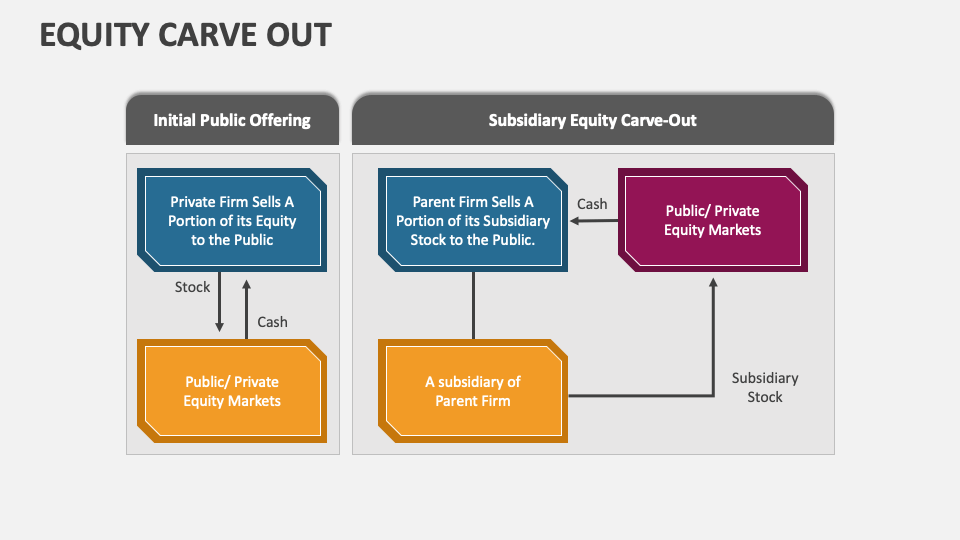

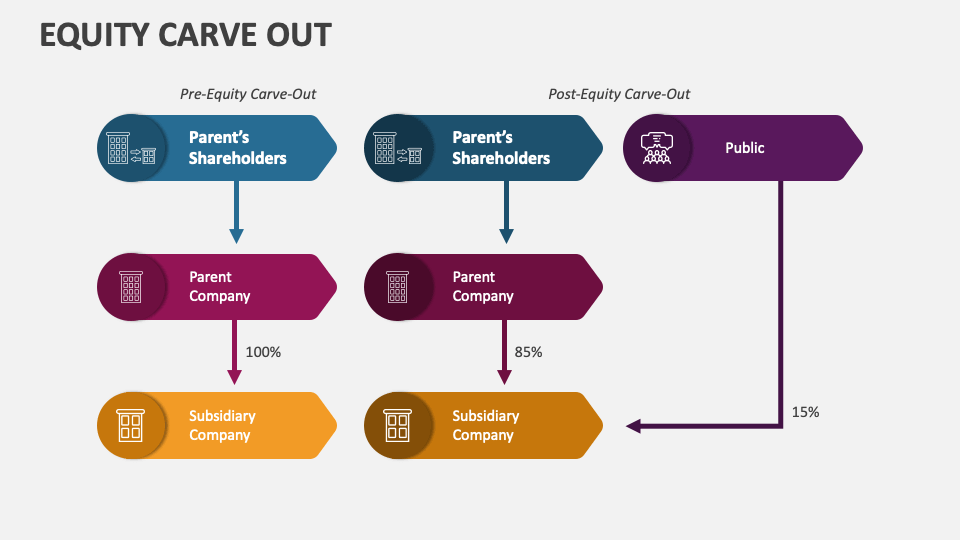

Carve-Out: A carve-out is the partial divestiture of a business unit in which a parent company sells minority interest of a child company to outside investors. A company undertaking a carve-out is.

What is Spin off, Split off, Equity Carve outs and Divestitures ? YouTube

Spin-Off vs. Split-Off vs. Carve-Out: An Overview . A spin-off, split-off, and carve-out are different methods a company can use to divest certain assets, a division, or a subsidiary. While the.

Equity Carveout What It is And Why Its Needed?

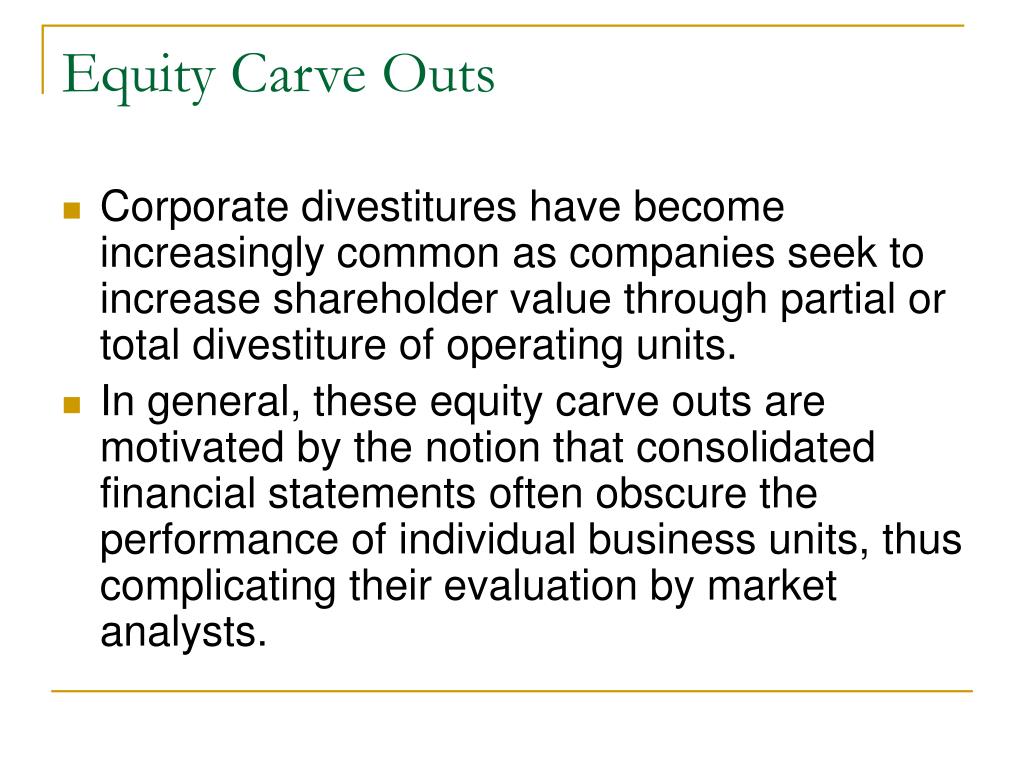

A spin-off, split-off, or equity carve-out are three varied methods of divestiture with the same objectives-Enhancing shareholder value Shareholder Value Shareholder's value is the value that company shareholders receive as dividends and stock price appreciation due to better decision-making by the management that ultimately results in a.

Equity Carve Out PowerPoint Presentation Slides PPT Template

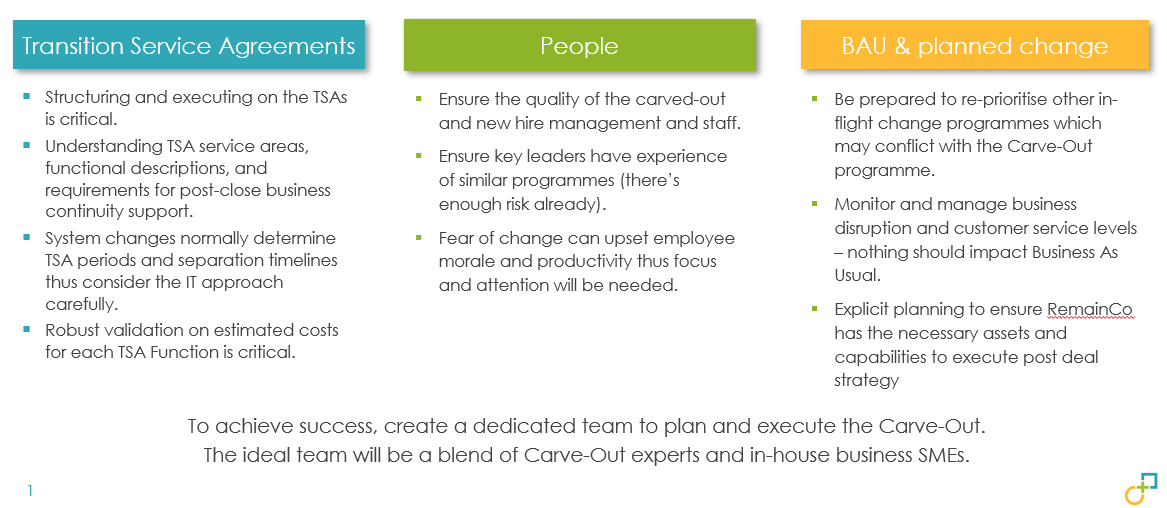

The parent entity can spin off 100% or distribute 80% and keep no more than 20% interest in the new company. This allows them to maintain their shareholder base during the divestiture process. 2. Tax Implications. A carve-out can have tax benefits, especially if the company is looking to do a corporate spin-off in the future (which many opt to do).

Carve Out Definition, Types, Process, Examples, Benefits

average spin-off and equity carve-out increased the parent's shareholder value by 6% and 2.5%, respectively, the day af-ter the transaction and outperformed the market by 20% and 10%, respectively, 18 months after the transaction. A classic example of equity separation is the equity carve-out of Infinity Broad-casting (INF) from CBS.

CarveOut Definition, How CarveOuts Work & Create Value

Carve-Out vs. Spin-Off. Spin-off deals are similar to carve-outs. In some cases, these are lumped in with carve-outs. Let's highlight how these deals differ from one another to make the carve-out procedure clearer. In a carve-out, the parent company targets a new buyer. It does not seek to sell ownership stakes to existing partners or stakeholders.

Which SOC Method Should You Use? CarveOut vs. Inclusive Schellman

Equity Carve-Out vs. Spin-Off. An equity carve-out achieves separation of a subsidiary without losing complete control, and is especially useful when a capital infusion is desired. When SubCo operates in a thriving industry, such as the Internet sector in the late 1990s, it may be preferable to monetize a portion of SubCo in a carve-out.

Equity Carve Out PowerPoint Presentation Slides PPT Template

Difference between Carve-Out and Spin-Off. Carve outs are similar to, and sometimes confused with spin offs. The difference, however, remains very straightforward:. Having participated in several equity carve outs over the past decade, DealRoom has been able to garner valuable insights into the process.

CarveOut AwesomeFinTech Blog

In general, there are four ways to execute a spin-off: Regular spin-off - Completed all at once in a 100% distribution to shareholders. Majority spin-off - Parent retains a minority interest (< 20%) in SpinCo and distributes the majority of the SpinCo stock to shareholders. Equity carve out (IPO) / spin-off - Implemented as a second step.

Equity Carve Out Definition, Benefits, Process

Carve out vs spin off. Also known as a "split-off IPO" or a "partial spin-off", it's easy to see why carve outs and spin offs are sometimes confused.. The main difference between the two is that in an equity carve out, the parent company divests some of its stake in the new subsidiary, which is then sold via IPO.

Equity carve out 💲 CORPORATE FINANCE 💲 YouTube

5 Summary. Spin-offs, carve outs, and split-offs are popular ways for parent companies to divest assets, divisions or subsidiaries. All three transactions often result in separate public equity of the divested assets. In an equity carve-out, the parent company sells a portion (usually less than 20% of the voting shares) of the shares it owns in.

PPT Module 8 PowerPoint Presentation, free download ID7045161

Many CEOs consider equity carve-outs (Exhibit 1) too good to miss: a financial instrument that increases company stock price without sacrificing. a carve-out followed by a spin-off usually also enables a parent company to divest a subsidiary without incurring the capital gains taxes that it would typically face in a trade sale or full IPO.

Carve out meaning & success factors for carveout projects

The 1987, 1992, and 1997 Use Tables are used to identify vertical relations in equity carve-outs and spin-offs during the periods 1986-1990, 1991-1997, and 1998-2005, respectively. A carve-out or spin-off is classified as vertically related if the vertical relatedness coefficient (VRC) is greater than 1%.

Divestment & CarveOut Challenges Private Equity Insights

Equity Carve-Out Vs. Spin-Off. There's a slight difference between spin-off and carve-outs. In the spin-off, the parent company does not receive any cash as the shares are issued to the existing shareholders in dividends, which is also known as a stock dividend. While in carve-outs, the parent company receives cash from its subsidiary.

Equity Carve Out PowerPoint Presentation Slides PPT Template

Many CEOs consider equity carve-outs (Exhibit 1) too good to miss:. In the United States, a carve-out followed by a spin-off usually also enables a parent company to divest a subsidiary without incurring the capital gains taxes that it would typically face in a trade sale or full IPO. For example, the carve-outs Guidant, Palm, and Lucent.

Equity Carve Out Vs Spin Ppt Powerpoint Presentation Styles Grid Cpb Presentation Graphics

Spin-offs, split-offs, and carve-outs are transactions that companies can use to divest assets, divisions, or subsidiaries. The choice of a specific method by the par-ent company depends on several factors discussed below. However, the ultimate goal is to recognize a situation where the market undervalues the parent company and hence attempt to.